Japan is insolvent, but “please don’t worry…”

This piece is an attempt at objectively examining the proposition that the Japanese government is effectively already bankrupt, and that even as we write this, events in the JGB market (i.e. huge volatility, suggesting deep concern about the government’s fiscal position) mean that it may well be just a whisker away from being perceived to be insolvent. Should this perception take hold, then it would quickly become a self-fulfilling prophecy. We are not proposing that the unfolding of these events are necessarily imminent, but the risk of default and insolvency is very real and could manifest themselves in an extremely unpleasant way at any time now. It is no longer so much a question of quantitative assessments, but more a question of changes to the qualitative perceptions of the various agents involved, i.e. the government, the BoJ and the various holders of both JGBs and equities (domestic savers, domestic institutions and foreign investors.)

We would like to stress that NipponMarketBlog does not take any pleasure in presenting this case. We have been happily investing in and visiting Japan for many years, and we would much prefer it if the Japanese economy managed to extract itself from its current predicament and return to a long term growth trajectory. However, we believe that investors must evaluate the facts objectively and make their investment decisions accordingly, and in this context that means facing up to the fact that default and insolvency are a very real risk in the not so distant future. Importantly, this not an attempt to predict the timing of an eventual sovereign debt default. This would be virtually impossible to do as it depends on a range of both quantitative and qualitative variables that are moving all the time.

Let us begin with the obvious point that Japan has by far the worst on-balance sheets debt situation in the developed world. So what is the government, the MoF and the BoJ going to do about this? Well, their main priority since the new government took office, seems to have been to fulfill what professor of economics at Auburn University, Roger Garrison calls the ‘Don’t just stand there’ criterion. Part of Shinzo Abe’s election program was to get tough on two things: The economy and China. Incidentally, it doesn’t take a genius to work out that the two are very obviously mutually exclusive, but we will address this in a separate piece in the near future.

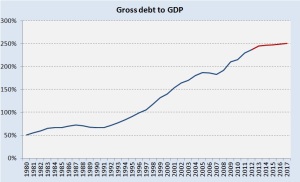

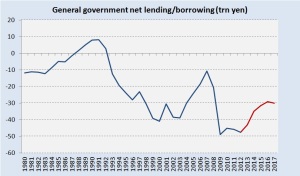

So Abenomics is now in full swing, and the International Monetary Fund seems to be buying the idea – at least for now. Using official IMF figures, we present a chart below showing general government debt to GDP going back to 1980.

The red section of the line is the official IMF forecast, which we are convinced is overly optimistic. The IMF has a clear interest in projecting figures that are as optimistic as possible in order to avoid adding to the current fragility of global financial markets.

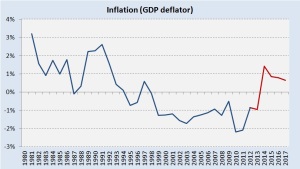

At any rate, the ratio of government debt to GDP has clearly accelerated since the real estate bubble collapsed and Japan began to enter its now multi-decade stagnation period. The reason the IMF expects the ratio to plateau over the next few years is because it expects something quite exceptional to happen in Japan. The following chart show the IMF forecast for the GDP deflator (inflation).

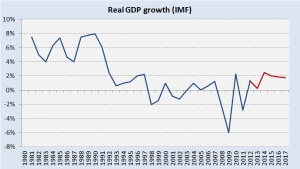

This is effectively the extent to which the IMF thinks Abenomics will work. The same assessment is reflected in the forecast for real GDP growth.

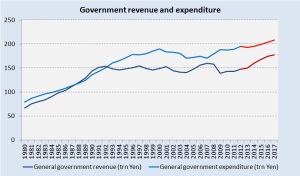

Please note that this is not nominal growth – this is real growth. In other words, it seems the IMF is entirely buying into the idea that Japan can reflate itself onto a growth path, and quite a significant one at that. The effect of this, according to the IMF, will be an increase in government revenues (presumably through higher taxable income). Spending is also expected to increase, but according to the IMF, revenue increases will exceed spending increases.

This of course will result in reduced government borrowing (which is a different way of saying deficit).

NipponMarketBlog remains highly sceptical about this entire outlook. We believe the expected positive impact on real growth is too optimistic, principally because we very much doubt that the inflation pressure the BoJ is attempting to create, will result in a significant shift in consumption and overall economic activity. It takes more than a few policy announcements from the BoJ and the government to change a deep-rooted deflationary mindset amongst the Japanese population. As we have argued before, this is especially true if at any point the efforts by the Mof and the BoJ begin to lose credibility.

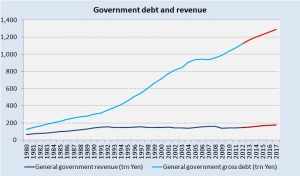

But even allowing for this optimistic scenario, the following chart of IMF forecasts for general government debt versus general government revenue is quite sobering.

Even with the increase in revenues built in to their forecasts, the IMF naturally ends up forecasting an ever-increasing mountain of debt, because of course the deficit is still there, so the government still has to borrow more money to finance itself.

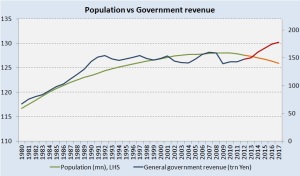

This brings us neatly along to a point about financing which is important to understand. The demographics of Japan dictates that structural government spending on the elderly will necessarily have to increase in the future, and because of the relative fall in the number of working age people, the tax revenues will necessarily have to decrease (barring much higher tax rates, which within the context of Japanese Realpolitik will be virtually impossible to implement). Let us look at the official population forecasts, and overlay the forecast for government revenue.

Given the peaking out in overall population which is in the process of happening as we write this, combined with the deteriorating ‘population mix’ from a net government expenditure point of view, the rise in the IMF’s forecast for government revenue seems odd, although by no means do we suggest that GDP is a linear function of the size of the population or even population growth. However, we can’t help thinking that there is a political agenda manifesting itself here.

Let us move on to the longer term perspective for demographics. From a fiscal management (i.e. government deficit) perspective, the following chart showing demographic pyramids for Japan for 1950, 2005 and 2050 is truly terrifying.

For the next several decades, the birth rates and death rates in Japan dictate an enormous skewing of the relationship between the portion of the population who need to be financed somehow, i.e. pensioners and other government support recipients, and the portion of the population that must do the financing, i.e. working age tax payers. Looking at this chart, and keeping in mind that government debt is already reaching 250% of GDP and still climbing even with an optimistic growth forecast for the next 4-5 years, one really begins to appreciate just how precarious the situation in Japan is. NipponMarkBlog would be very surprised if deep inside the MoF the bureaucrats have not tried to model the longer term forecasts for public finances, and we can only imagine how horrifying that must look. It is perhaps no wonder that a now former finance minister, after ratifying the government’s budget, immediately checked himself into a hospital citing debilitating anxiety.

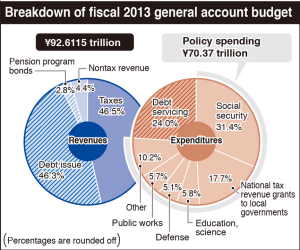

For a snapshot of the current fiscal position of the Japanese government, the following illustration lays out the break-down of revenues and expenditure for fiscal year 2013:

Note how almost half of the funding is already coming from new debt issuance, and also how debt servicing is around 25% of total expenditure. Truly terrifying numbers, especially considering that demographics dictate a large increase in ‘Social security’ spending, and a significant decrease in ‘Taxes’ over the coming several years and even decades.

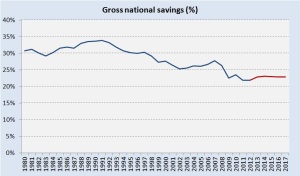

At any rate, it is obvious that the government can only keep financing this growing debt for as long as they can persuade either domestic or foreign investors to continue to purchase JGBs. Given the demographic reality that will play out over the next several decades, it stands to reason that the current holders of JGB will begin to dissave and thus sell their holdings. These holdings after all represent their nest-eggs, and so an accelerating draw-down of these funds is both inevitable and likely to increase over the coming years. The following chart shows the savings rate in Japan.

From this chart we see that the savings rate is indeed falling, and will likely continue to do so for the structural reasons mentioned above. Lower savings means less funds to absorb government selling of JGBs to finance its deficits. Precisely how the IMF manages to conclude that the savings rate will actually go up (thus providing opportunities for the government to keep financing deficits), when the total population number will be falling, the demographics are turning against the government, the global economic leading indicators are rolling over, and when the whole premise of growth in Japan is based on Abenomics induced increased consumption (which is the opposite of saving), is frankly a mystery to NipponMarketBlog. Again, we suspect the IMF figures are dictated more by the politics of global financial market anxiety management than by reality.

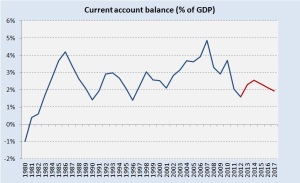

At any rate, at some point the savings rate will inevitably fall to a point where the Japanese government can no longer finance its deficit domestically, and when this happens it will have to turn to international ‘sponsors’ of its deficits. Of course, for as long as Japan runs a current account surplus of sufficient size, the financing is available, but if and when that changes the only option left for the government to finance its deficit is to turn to international capital markets and foreign investors. The chart below shows Japan’s current account.

Note again how the IMF’s forecasts point to an improvement in the current account. Again we are highly perplexed by this. If the IMF is expecting global growth to slow, and Japanese growth to pick up, then surely this will lead to higher imports and lower exports, and thus a deterioration in the trade balance and the current account. Or has the IMF already incorporated a much weaker Yen into its estimates? This is the only way one can explain this forecast. We have obtained the latest monthly data from the BoJ, which unfortunately only goes back to 1996, but the recent data points are illustrative.

This is not quite pointing to the rosy scenario the IMF is forecasting. Note also that the downward trend has continued, even through the period from late summer of 2012 during which the Yen has been weakening and thus helping exporters. Assuming the IMF is being overly optimistic, the current account is actually going to head further south towards an eventual more permanent deficit.

In the event that the government has to turn to international capital markets for financing, this will of course mean that new marginal buyers of JGB’s (foreign investors) will demand a higher rate of return (bond yield) on their investments, and that will push up rates. This is especially going to be the case if the perceived risk of default is beginning to lurk in the shadows. But higher required rates on JGBs is exactly what the MoF and the BoJ do not want, as this will be the end of the road for Abe and Kuroda’s massive monetary and fiscal experiment.

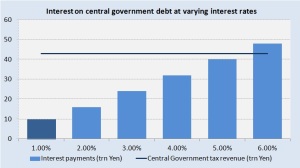

Below is a simulation of interest expenses relative to central government tax revenue. We look at central government here since this is the only entity that can issue JGB’s. The figures are very rough guesses, simply because unambiguous data is difficult to find, but the broad message ought to be clear. Currently the interest expense is around 10trn Yen, and central government tax revenue is around 43trn Yen. So here is what happens if interest rates start rising.

Assuming a roughly 1% financing cost at present (dependent on the actual maturity mix of JGBs) and using these back-of-the-envelope estimates, we surmise that if rates rise to just over 5%, the Japanese central government will be spending all of its tax revenue just on interest payments on its debt. Of course, the government and the BoJ can never actually let it come to that point, or rather, the markets will never accept this. Getting too close will cause the market to call out the BoJ on its dysfunctional monetary strategy, and the JGB market will collapse.

This, in a nutshell is why this reflation experiment on the part of the BoJ is so immensely dangerous. As soon as the market starts to doubt whether this experiment will succeed and generate growth and tax revenue through inflation and consumption (something we highly doubt is even possible), the game will be up. Any loss of confidence in the government and the BoJ will send JGBs plummeting, rates soaring and the effective debt service burden soaring to a level that the government can no longer realistically finance. The whole situations seems balanced on a knife’s edge. At the first sign of the BoJ flinching, the markets will call it out and the entire plan will collapse in the mess that is a sovereign debt default.

NipponMarketBlog can not help get the sense that we are watching an enormous game of musical chairs play out. Who is going to blink first? Who’s going to be the first one heading for the exit? Of course, for as long as JGB markets are stable, everything is fine, but the moment that starts to change the whole thing could unravel very quickly indeed.

An additional dimension to this issue is the fact that on top of the natural JGB selling pressure caused by demographic changes, Japanese institutions are feeling increasingly pressured to attempt to find yield outside of Japan. This quote is from the Wall Street Journal:

“Two of Japan’s biggest life insurers said Monday they might increase their purchases of foreign bonds and reduce or keep steady their purchases of domestic bonds this fiscal year, as the central bank’s aggressive easing program forces big investors to rethink plans. Nippon Life Insurance Co., Japan’s largest life insurer, and Asahi Mutual Life Insurance Co., the eighth-largest, both said they will consider putting more new investment money into foreign bonds if domestic yields remain near historic lows…”

All else being equal, this will put upward pressure on Japanese interest rates and hasten the arrival of the point where markets finally lose confidence in Japanese authorities, resulting in a collapse of the JGB market, and the Japanese government being deemed insolvent and bankrupt in short order.

It would of course be naive to suggest that these events could unfold without some sort of effort to contain them along the way. The government and the BoJ would almost certainly try to intervene if it began to appear as if they were losing control of the situation, but their problem is that there is very little they can do having already started this monetary reflation project. If we assumed that, due to the broken transmission mechanism from monetary stimulus to economic growth, the economy turned out to grow significantly less than government debt, then debt to GDP would continue to rise. In that event, the only thing the government could do would be to either cut expenses or raise taxes. Cutting expenses would be virtually impossible, because such a large (and rising) proportion of expenditure goes towards essential commitments such as care for the elderly, and another significant proportion goes to paying interest on the existing debt. Raising taxes would almost certainly choke off any chance of the economy recovering, especially in an environment where economic growth in the rest of the world is slowing down. The other scenario in which the government and the BoJ would need to react is if capital markets began to lose faith in the reflation project itself (possibly believing that rates would eventually rise uncontrollably) with the result that the JGB market became unstable. In this event the only possible option would be to reverse course on monetary expansion, but that in itself would immediately remove any confidence the market ever did have in the BoJ’s strategy, and so the JGB market would collapse anyway. In essence, once a government has set a course down the path of monetary reflation there is no turning back. The Japanese authorities are now committed, and it appears to us that the whole thing rests more on hope than on confidence – something that is always a very dangerous situation when it comes to finance.

To be blunt, the Japanese government and the BoJ are engaging in the most high stakes game of poker imaginable. Virtually everyone accepts that Japanese public finances are more or less beyond repair and that short of printing money day and night, the Japanese government is effectively both broke and insolvent. There simply is not a realistic chance of the current debt ever being repaid, and there is a very real chance that any future rise in interest rates will push interest payments on government debt up to entirely unsustainable levels vis-a-vis tax revenues, after which only debt restructuring (default) represents a realistic way out.

Outwardly however, the Ministry of Finance, does not appear to be overly worried. On the MoF’s website one can find a Q&A session, likely designed to help savers and investors in JGB’s understand the current situation, and possibly allay any fears they might have about the future of the JGB market. One of the questions is:

“If Japan has a financial collapse, what will happen to its government bonds?”

The official Ministry of Finance answer is as follows:

“The government bonds will be redeemed because the government is responsible. Please do not worry.”

Oh good. We here at NipponMarketBlog feel better already.

22 responses to “Japan is insolvent, but “please don’t worry…””

Trackbacks / Pingbacks

- - April 30, 2013

- - May 13, 2013

- - May 23, 2013

- - June 16, 2013

- - June 19, 2013

- - June 23, 2013

- - August 3, 2013

- - August 9, 2013

- - August 9, 2013

- - August 12, 2013

- - August 20, 2013

- - September 25, 2013

- - October 1, 2013

- - November 6, 2013

- - January 28, 2014

- - March 24, 2014

Another excellent article many thanks NipponMarketBlog. I totally agree with your analysis – I would certainly not want to lend the Japanese government any money. I don’t doubt that they will redeem the bonds- but what I will be able to buy with my JPY when they redeem them is uncertain as they print the currency.

It seems most government finances are shot to pieces e.g. US, Europe, Japan – but being short govt bonds would have been very painful and the weak public finances has been apparent for a long time.

How do we make money on this analysis? shorting JPY is always a relative trade.

long NOKJPY? Norway has excellent public finances.

maybe long real assets (oil/gold/copper) – short JPYUSD? so i can capture commodities denominated in JPY.

any thoughts would be welcome.

Reblogged this on asamy.

When I initially commented I seem to have clicked on the -Notify me when new comments are added- checkbox and from

now on every time a comment is added I get 4 emails

with the exact same comment. Perhaps there is a means you can remove me

from that service? Thank you!

I think that is a WordPress feature, and I am not sure how to remove it.

You might have to unsubscribe, and then resubscribe….

I found this amazing blog post , “Japan is insolvent,

but “please don’t worry…” | NipponMarketBlog”, fairly pleasurable not to mention it

was in fact a great read. Regards,Heriberto

Thank you very much sir.